In this post, learn how to find a dentist that accepts your insurance, understand your plan, and maximize your dental benefits.

3 Things to Know About Dental Insurance

With the new year comes the reset of dental insurance benefits. Understanding your dental insurance is key to making smart choices about your oral health. Here are three dental insurance tips to keep in mind to help you maximize your dental dental this year!

1. Coverage and Limitations

Dental insurance plans can be quite different, so it’s crucial to know what your plan covers. While most plans take care of preventive services like cleanings and exams, the extent of coverage for restorative work and orthodontic treatments varies. Make sure you’re also clear about any deductibles, co-pays, and annual maximums to avoid surprises and plan your dental care effectively.

2. Out-of-Network vs. In-Network Providers

Choosing an in-network dentist can save you money. These providers have agreed upon fees with your insurance company, which means lower costs for you. Always check if your dentist is in-network before scheduling to make the most of your insurance coverage and reduce your expenses.

3. Preventive Services for Long-Term Savings

Investing in preventive dental care is a smart move for both your health and wallet. Most insurance plans cover services like cleanings, exams, and X-rays, which can help catch issues early and avoid more expensive treatments down the line. So, don’t leave that money on the table! Make the most of these benefits to keep your smile healthy throughout the year.

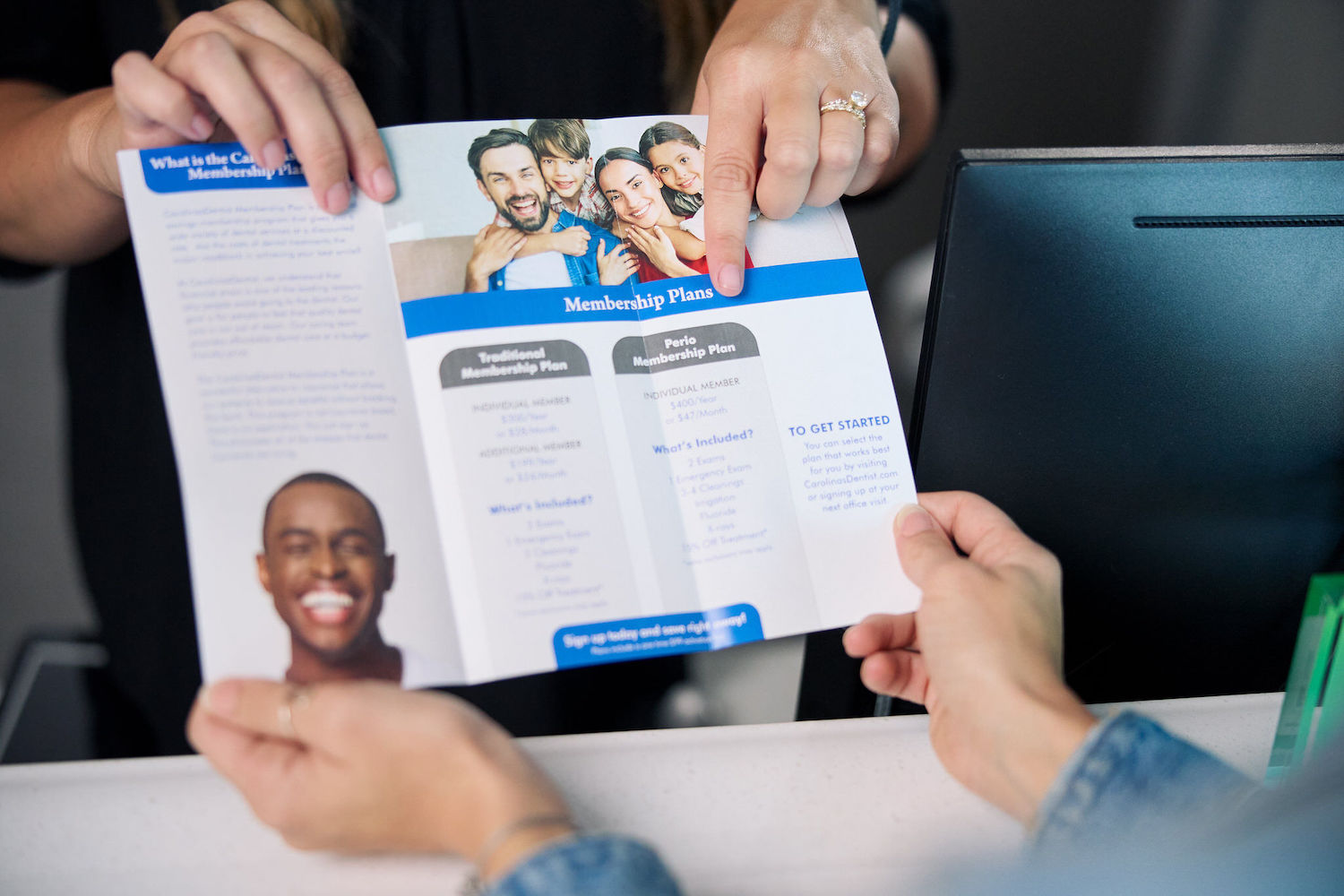

Dental Insurance, In-House Membership, and More at CarolinasDentist

No matter if you have dental insurance or prefer a different payment method, regular preventive checkups are crucial. Staying on top of your dental health maximizes your insurance benefits and helps with budgeting. If you have any questions about more dental insurance tips or our payment options, feel free to reach out to us!

Image: Dr. Amruta Bahekar, DDS explains treatment with a patient at our Fayetteville location.